Investing in the United States, Canada, and beyond requires an eye for detail and a rock-solid trading strategy. In order to find great investment opportunities, you must constantly be on the lookout for fast-moving or long-trending assets that will net you great profits.

With a commitment to consistency in your research and a true understanding of your personal risk tolerance, finding excellent investment opportunities within commodities and indices markets becomes a simple task. Whether it’s crypto, gold, or antique collectibles; there are countless ways to increase your income with investments. Consider these eight diversified starting points when approaching new investments.

1. The Indices Themselves

Traders thrive when they have a strong trading strategy and great security behind them. Index funds, ETFs, and other fund-type investments offer a bundled strength that’s hard to find with any other asset class or within the NYSE itself.

Index funds are great for providing investor alerts tailored to your needs, with additional alert options as a standard beyond the typical quarterly investor email alerts common among publicly traded companies. The technical analysis is built into the commodity itself and offers a set-it-and-forget-it method for traders.

2. Gold Bullion

Gold is a wonderful asset to own. Ounces of gold appreciate in value over time beyond the typical returns seen in a variety of other asset classes. An ounce can also be used as a collateral asset for future account borrowing. Boosting your borrowing ability is crucial for investors who are looking to fund the purchase of a new home, car, and many other expenses.

3. Real Estate

The property market is also a great hedge against the stock market’s volatility. Third-party investment advisors often tout the real estate market as one of the strongest over the long term. Real estate and gold often work in tandem for diversified investors and can both act to buoy your portfolio against external volatility.

4. Individual Stock Picking

Selecting great stock market commodities is a time-honored practice for investors and traders. Companies like Alamos Gold (NYSE:AGI), headed by new CEO John A. McCluskey, offer unique growth potential alongside excellent quarterly dividend returns and make for a staple within many investors’ portfolios.

Traders investing in Alamos (officially Alamos Gold Inc.) are buying into hundreds of thousands of ounces of gold extracted across three active mines each year—the Young-Davidson and Island Gold Mines in Northern Ontario and the Mulatos Mine in Mexico. Yet this isn’t the only feature of the Alamos brand.

Alamos is a pioneer in environmental protection measures as well. In addition, Alamos has committed to eliminating cyanide usage at their mining operations, and cash flow hasn’t trailed off—as some might expect—as a result of slightly more expensive processes.

5. Cryptocurrencies

Investing in the crypto market is a hot commodity at the moment as cryptocurrencies fit snugly within any great trading strategy. The cryptocurrency market, including Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC), is booming with thousands of unique crypto coins and tokens traded around the clock.

Crypto trading strategies often employ a varied approach to crypto assets, because there are so many different approaches—such as crypto exchanges—that a cryptocurrency trader can employ in their daily trading diet. Cryptocurrencies are a liquid digital asset and offer traders an excellent free cash flow that can act as a reserve currency for purchasing as well as investing. Using technical indicators to approach these digital assets is a great way to find excellent movement within the cryptocurrency market as well.

6. Jewelry

Jewelry is a great investment for anyone who likes to appreciate the finer things in life. An exquisite necklace can act as a centerpiece in your portfolio as well as a commodity that you can wear on a night out on the town as a statement-maker. Jewelry is a glitzy investment option that many people take advantage of.

7. Bonds

For stability over the long term, nothing beats the bond market. Bonds offer rock bottom appreciation, yet their returns are guaranteed—a promise that isn’t made with any other investment option on this list. Bonds are an excellent way to protect your principle and should form a small component of any investor’s portfolio.

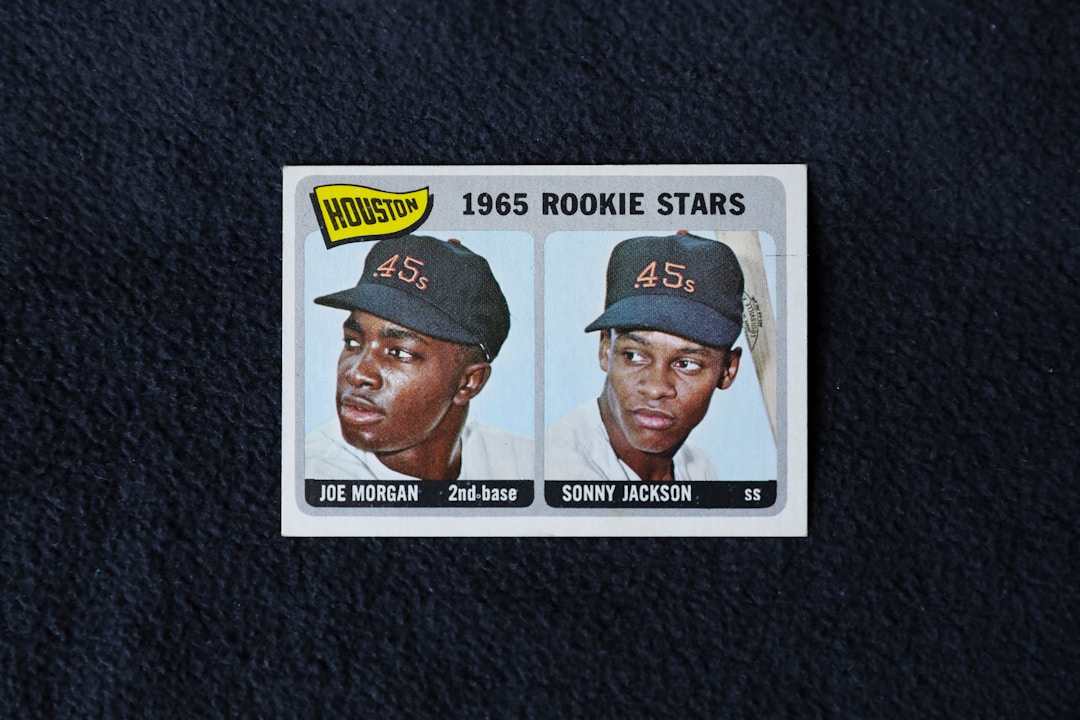

8. Collectibles

Collectible items offer a unique way to approach the investment landscape. Rare baseball cards, Beanie Babies, and many other collector’s items are worth a fortune to the right buyer. Your hobby as a child, or a keen eye for a great bargain in the current market, can net you huge profits if you approach this option in the right way.

Investing is all about diversity, use this list of commodities to jumpstart your wealth-building.